Maintenance is ~10% of airline operating costs, and airlines are in cost-conservation mode.

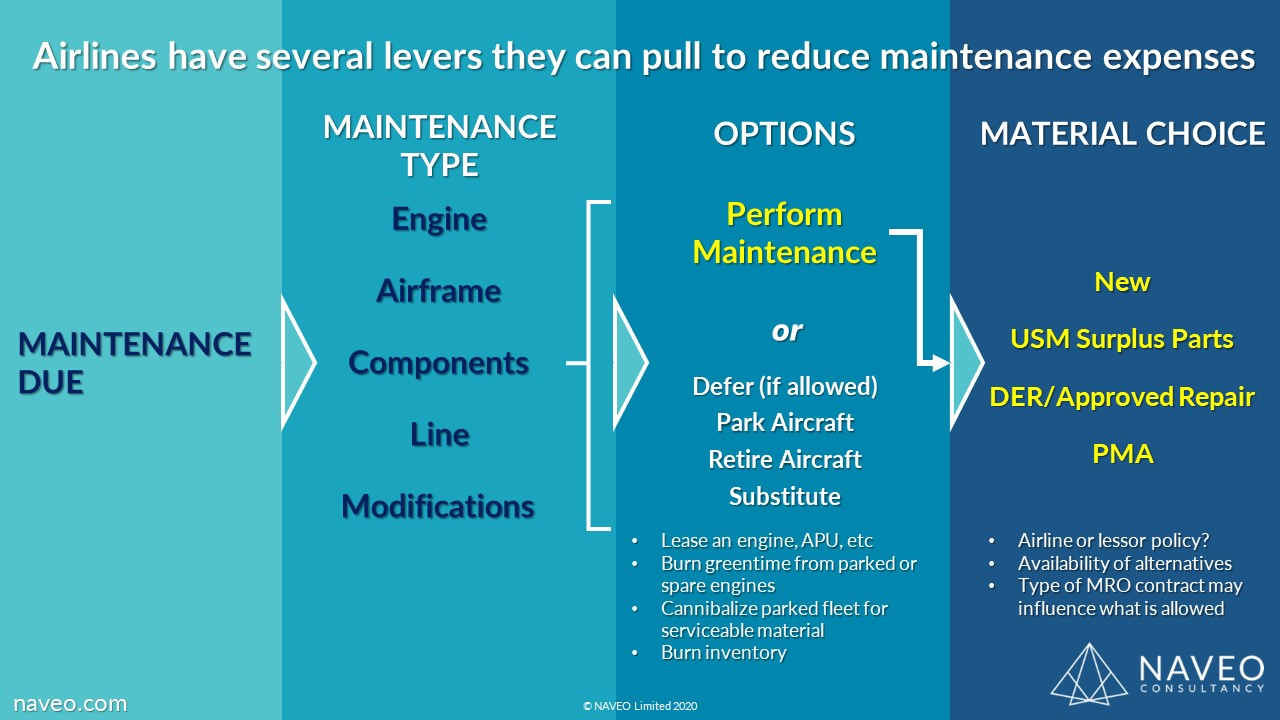

Airlines have several options to reduce MRO spend. Whether to perform the MRO or not may depend upon MRO type and MRO alternatives (e.g., leasing in an engine or part, burning greentime, USM, etc.).

They may have options regarding material to use, which may avoid new parts (critical to OEM profits).

Options depend upon airline and, if relevant, lessor policies. Also, there may not be any alternatives to the OEM part. The point is, however, that they may well have options.

It’s also vital to consider if the MRO is a relatively high cost (e.g., engine shop visit)? The higher the cost, the more likely for deferral or alternatives. Is the maintenance discretionary (e.g., cabin upgrade) that could be deferred? Is the aircraft owned or leased? What requirements does that place upon the operator (and is an end-of-lease check due)?

It’s worth considering the type of MRO contract that the airline has with its supplier. If they have paid by the hour, the operator may send the engine or component for overhaul/repair.

Finally, does the airline have the in-house capability, or is the MRO outsourced? That may also impact whether they perform the maintenance or delay it.