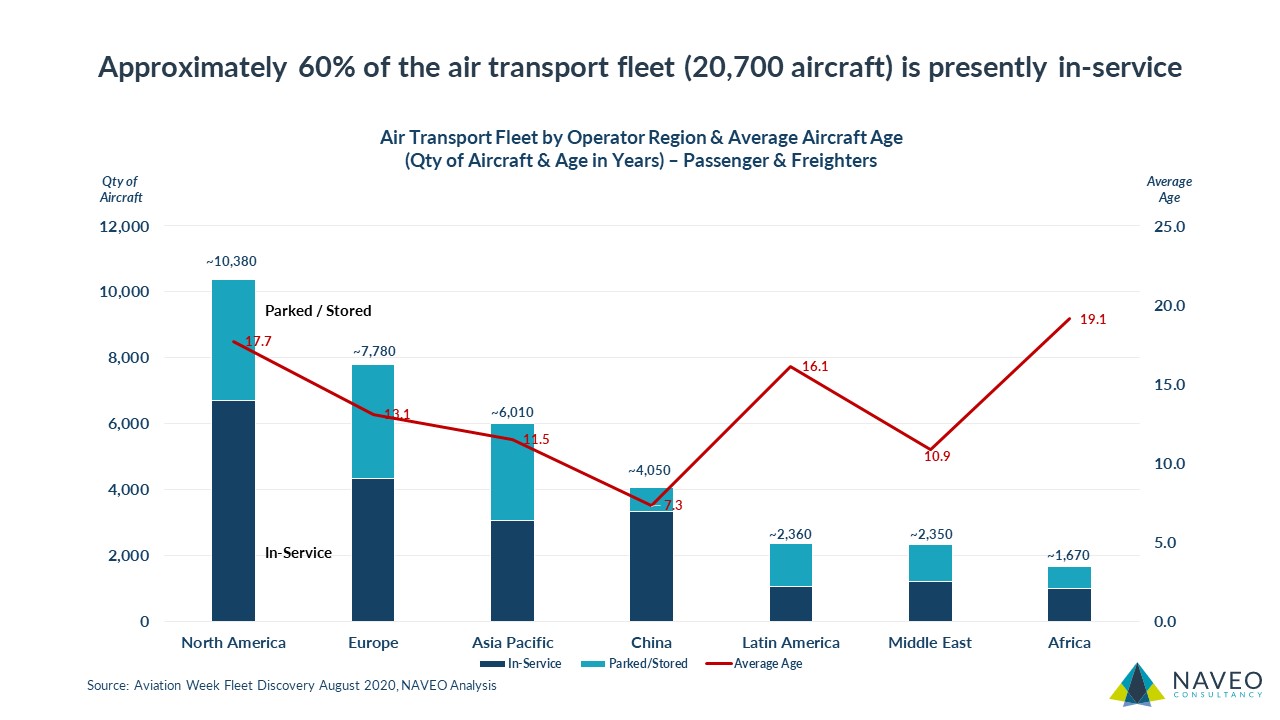

Let’s see how many aircraft in mid-August 2020 are currently in-service, parked/stored, average age, and how the % in-service/parked varies by region. Overall, ~60% of the fleet is in-service and the average age (active and parked) is ~13.8 years old.

Regionally, China leads the way with ~80% of its fleet in-service. North America has ~65% in-service, Europe ~55%. Latin America has only ~45% in-service.

In the chart below you can see that strong deliveries in the past from emerging growth economies result in a younger fleet. Many of these aircraft in growth economies are under warranty or haven’t had their first engine shop visits or heavy maintenance events. For instance, the average age of the Chinese fleet is just seven years.

The North American fleet averages ~17.7 years of age. Hence, we’ve been in a fleet-renewal phase in North America retiring aging passenger aircraft such as MD80s, 757s, 767s, and replacing them with A320Neos, 737 MAXs, A220s, 787s, and A350s.

For those that love cargo, the data below includes cargo aircraft. But, there are ~2,300 dedicated cargo aircraft with an average age of 26.3 years. If we only look at the passenger fleet (excluding cargo), the average age falls to ~12.7 years.