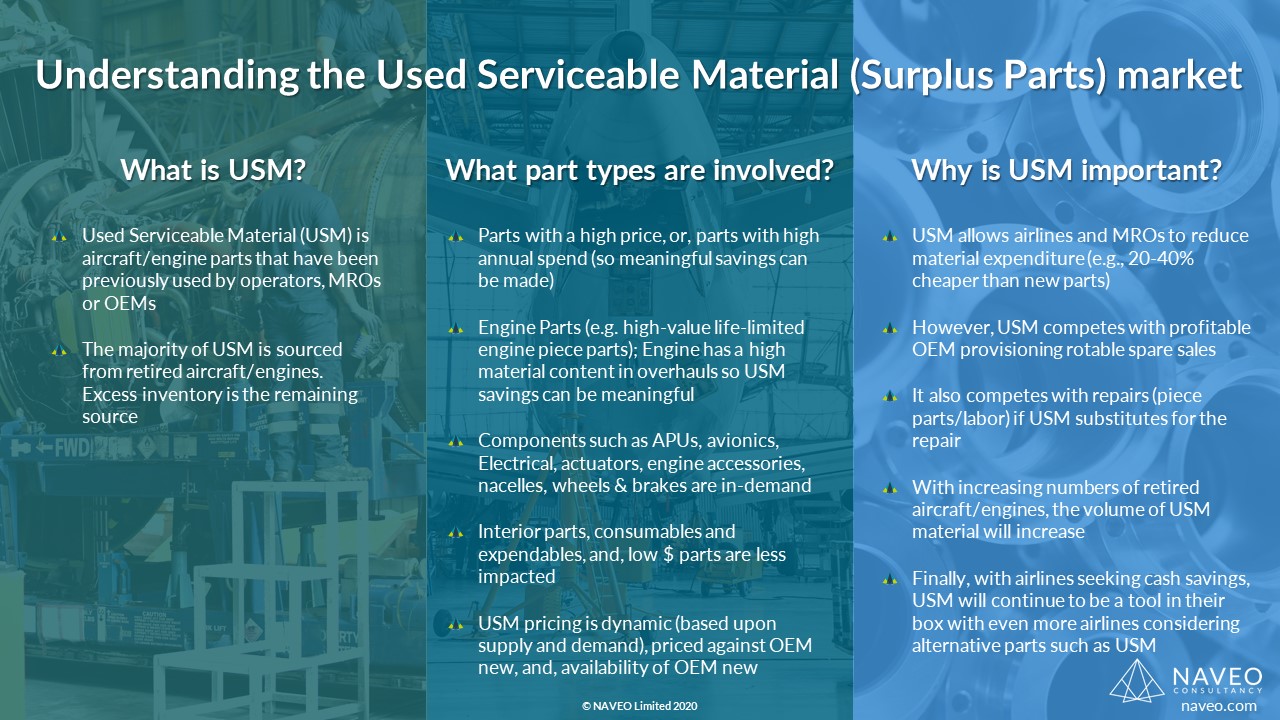

One of the key MRO trends over the past decade has been the growing importance of Used Serviceable Material (USM) – also known as Surplus Parts. The past decade saw aircraft acquired, retired, parted-out, and their parts and engines sold to operators and MROs.

The majority of USM is sourced from retired aircraft/engines. Thinking about what types of parts are involved in USM, we should consider parts with a high price or parts with high annual spend (so meaningful savings can be made).

Pricing of USM is highly dynamic (based upon supply and demand), priced against OEM new, and the availability of new OEM material.

But why should we care about USM? Well, USM allows airlines and MROs to reduce material expenditure (e.g., 20-40% cheaper than new parts). However, USM may compete with profitable OEM provisioning rotable spare sales and repairs if USM substitutes for the repair.

OEM participation in USM allows them to gain valuable information on part pricing and availability. It also allows them to serve a price-sensitive customer segment that might not be current customers.

Since airlines are laser-focused on cash conservation, many will evaluate ways of saving money on maintenance, and USM provides one option. #NAVEO #Aerospace #aircraft naveo.com