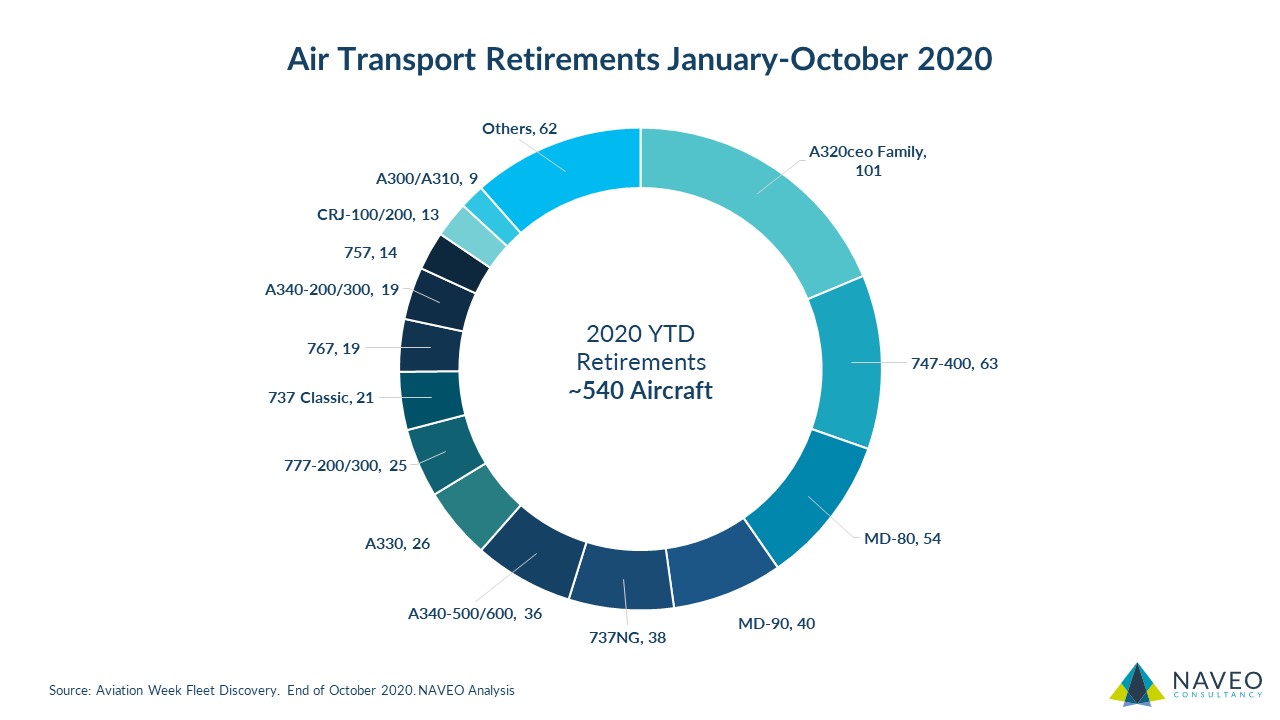

As of the end of October 2020, approximately 540 air transport aircraft had been officially retired and withdrawn from use. That’s ~2.6% of the active fleet. These include ~100 A320ceos, 63 747-400s, 54 MD80s, 40 MD90s, 38 737NGs, 26 A330s and 25 777s. ~51% were narrowbodies, 40% widebodies, and 9% were regional jets and turboprops.

In terms of the average age of aircraft retiring so far this year, it’s been 23.7 years for narrowbodies and 22.2 years for widebodies. There were ~60 aircraft that were under 15 years of age (including A340-600s, E-Jets, A380s, A320ceo family, and 737NGs).

When aircraft are retired, most of the residual value is in the engines since some of the engines may have greentime remaining and/or USM that can be reclaimed for use in future engine shop visits. Given the aircraft models, ~195 CFM56-5B/7B engines, 82 V2500-A5s, 16 GE90s, 30 Trent 700s, and 22 Trent 800s were retired.

There are many more aircraft currently stored (~13,000), and we expect some of these won’t return to the sky given the traffic outlook. Airlines and lessors are playing wait-and-see before deciding to turn stored/parked aircraft into retired aircraft that won’t fly again. Hence, the official retirements so far are still in the hundreds and not thousands.