You may have heard that recently, two A321neo aircraft powered by Pratt & Whitney GTF engines had been purchased to be torn down, their engines and parts reclaimed to support the existing A320neo fleet. Both aircraft were only six years old.

On the one hand, we hear complaints from airlines not receiving their new aircraft soon enough, production delays causing continued frustration and engine durability issues keeping some aircraft grounded. Then, we hear about the latest generation of in-demand aircraft being retired.

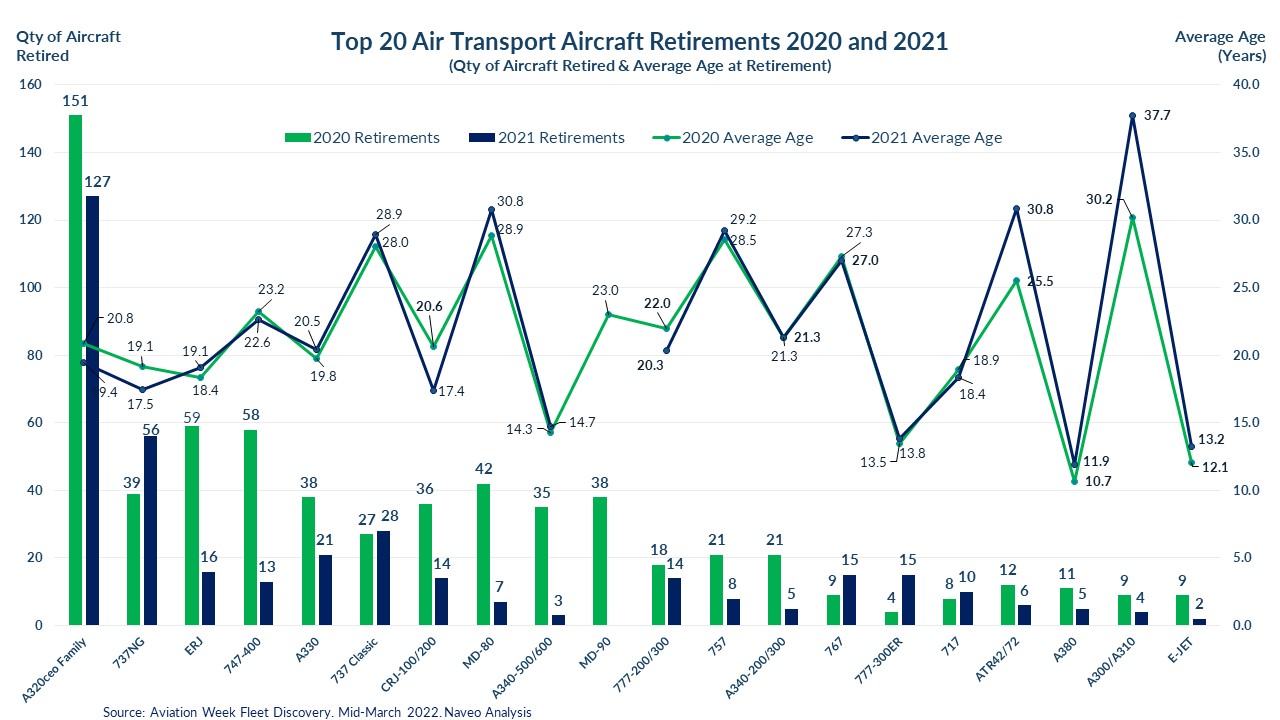

So, what is going on? Well, it’s not a new phenomenon to see young aircraft prematurely retired. Go back a decade, and we’d have debates about whether the economic life of aircraft was shortening.

Most of the prematurely retired aircraft were usually leased before retirement. They were often sold by their lessor owners to (typically) private-equity backed investors who might own Used Serviceable Material (USM) trading businesses. Such firms saw the earning potential by selling engines (often burning off the green time before parting out) and parts.

It is a financial play that has seen billions of dollars of investment from private equity and others (e.g. OEMs, MROs and some airlines such as Delta) to acquire aircraft for teardown. There’s been a plentiful supply of capital searching for aircraft/engines to acquire and disassemble. Lessors are willing to sell the aircraft and bank the maintenance reserves. It’s a financial play for them, too.

Currently, the pricing of aircraft/engine assets is higher as retirements are lower. With more investors chasing fewer aircraft assets for teardown, many comment that the business case is more challenging. They don’t want to overpay for assets.

Aircraft being owned by a lessor is key. Approximately 75% of retired 737-800s were owned by lessors before being acquired for teardown. Airlines that own their own aircraft have tended to keep them in service for longer.

So far, ~11 A320neo family aircraft have been retired, with an age of between 5 and 7 years.

All retired A320neo family aircraft were powered by the Pratt & Whitney GTF. Engine durability issues are encouraging early retirement, perhaps because aircraft have been sitting without engines as gliders, and there’s such a high demand for GTFs for the existing fleet. Lessors had owned all aircraft. All had been previously flown by airlines in India.

We haven’t seen a LEAP-powered A320neo family aircraft retired yet, nor a Boeing 737 MAX purchased for teardown.

If you are searching for A320neo family teardown aircraft, consider contacting Irish lessors who have aircraft in the Asia Pacific region!