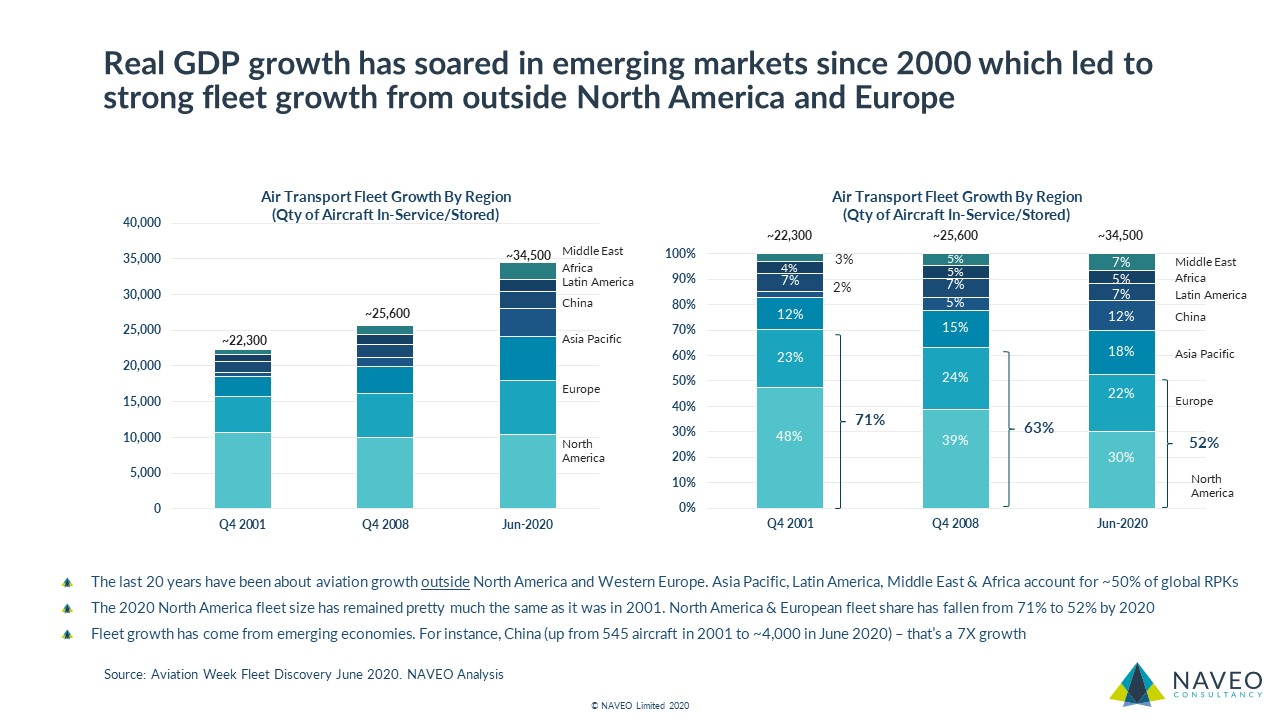

As aerospace OEMs have released their quarterly financial results, we are reminded not only of the impact on revenue from painful OE production cuts but also the importance of aftermarket revenue (including spare sales) to profitability.

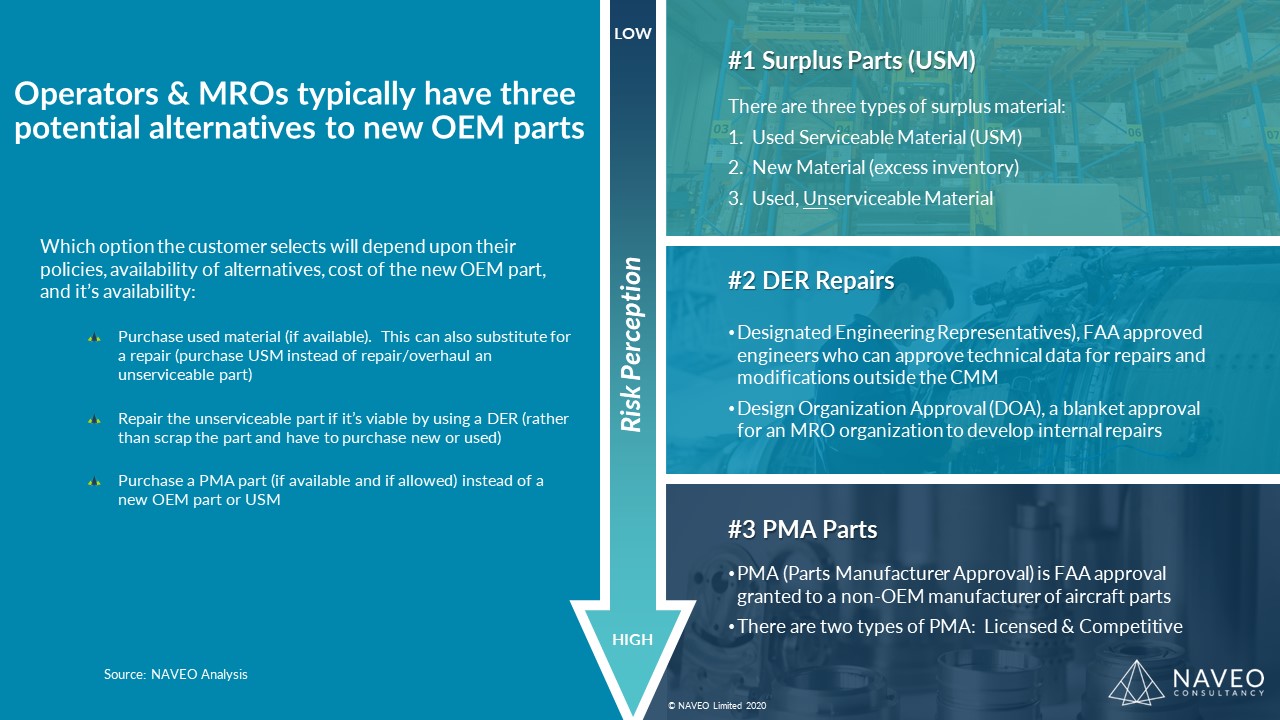

Operators & MROs typically have three potential alternatives to new OEM parts. They can purchase used serviceable material (USM), they can consider repairing the part (DER repair), or, they could purchase a PMA if one is available and their policies allow. Which option the customer selects depends upon policies, availability of alternatives, cost of the new OEM part, and its availability.

Pre-COVID 2019 Air Transport MRO spend was ~$87B. Of this, ~$35B (40%) was materials, of which ~$5B was USM, and ~$725M PMA. Part repair (DER or OEM-approved), particularly in engine MRO, is ~$6B+ market.

OEMs, MROs, and specialist suppliers understand this so many offer alternatives to new OEM parts to customers looking for choice and cost savings. Given budgets at airlines and MROs are tight and under scrutiny, it makes sense to evaluate potential options to reduce MRO spend. Note, OEMs do repair parts, and in particular, the engine OEMs are some of the biggest consumers of USM incorporating used material into engine overhauls. hello@naveo.com #NAVEO #Aerospace