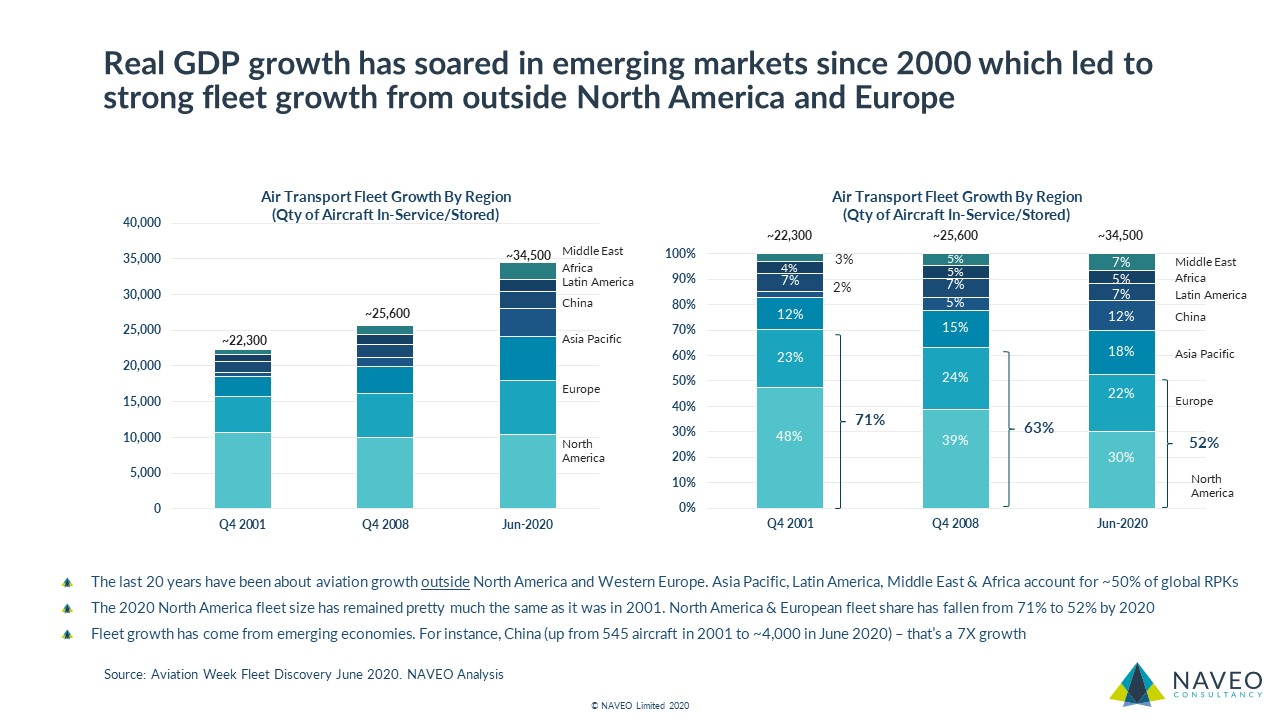

Ok, so just a quick history lesson. Over the past twenty years, fleet growth and, consequently, MRO growth has been driven by emerging economies, far less than by North America or Western Europe. The composition of the fleet, the operator types, the way they purchase maintenance, the level of MRO outsourcing, inventory in the supply chain, the role of the OEMs in the aftermarket, etc. have continued to evolve since 9/11 and the 2008 Financial Crisis.

As you can see below, North America and Europe’s share of the air transport fleet (active & stored) has fallen from 71% in 2001 to 52% in 2020.

Why does this matter? Because we should pay attention to how airlines and MROs are performing in growth economies, and, how traffic is returning – since it’s these regions that have significant new aircraft backlogs and are driving the aftermarket growth going forward #Aerospace #Aviation #MRO #NAVEO

Industry Insights

More News

Date: March 29 , 2022 |

Air Transport Aircraft Retirements Update |

The air transport aircraft retirement tsunami that was expected has, so far, failed to materialize. 2021 saw the lowest official retirements since 2007, with only ~429 aircraft being recognized as being officially ret... |

READ MORE      |

Date: November 23 , 2021 |

Tracking the Air Transport Utilization Recovery |

April 2020 marked the low point in air transport fleet utilization. Since then, aircraft flying hours have been steadily increasing. However, the speed of the recovery has varied by size of aircraft (e.g., narrowbod... |

READ MORE      |

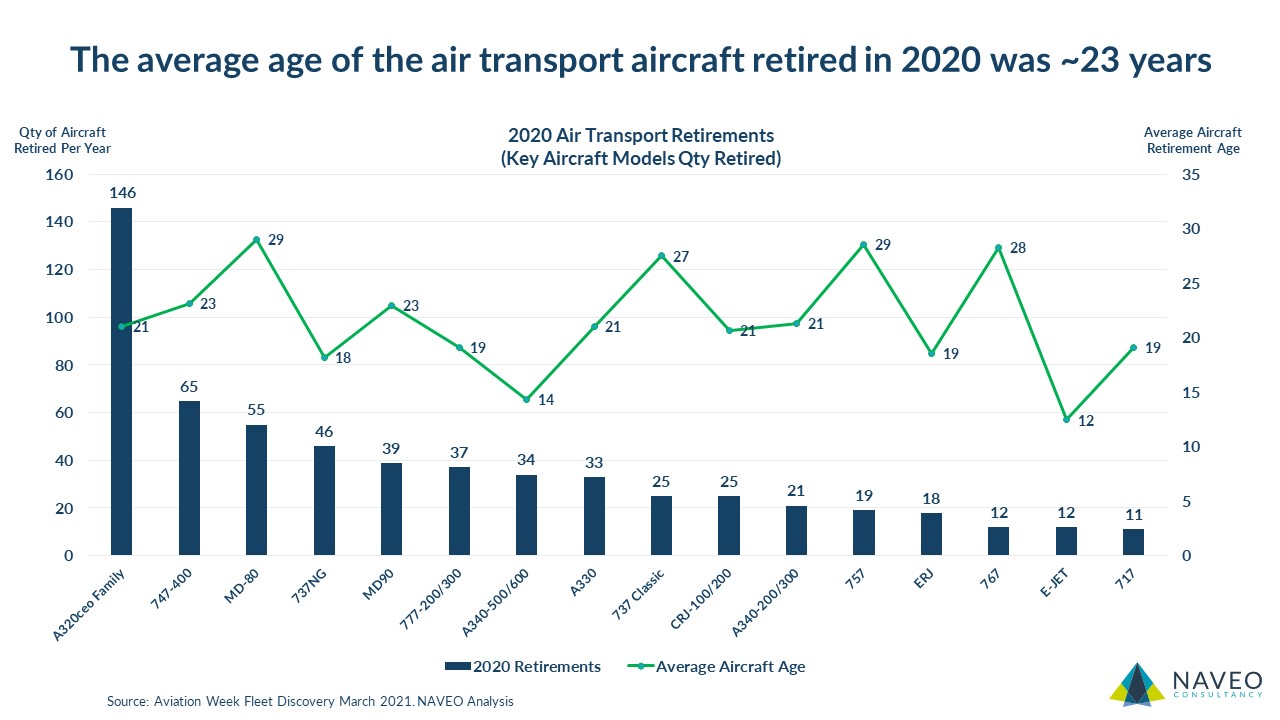

Date: March 12 , 2021 |

Reviewing 2020 Aircraft Retirements |

So, how many air transport aircraft retired in 2020? Thousands? Nope. 2020 did not yield the thousands of retirements that had been feared. Though the final tally will be subject to revision in the coming months, so f... |

READ MORE      |